Documenting crony capitalism

| This is a research project at Wikiversity. |

- This essay is on Wikiversity to encourage a wide discussion of the issues it raises moderated by the Wikimedia rules that invite contributors to “be bold but not reckless,” contributing revisions written from a neutral point of view, citing credible sources -- and raising other questions and concerns on the associated '“Discuss”' page.

In Republic, Lost, Harvard law professor Lawrence Lessig claims that few major problems facing the United States today get the attention they deserve in congress because political campaigns are all financed by private donations. He calls this the "gateway problem", because he believes it must be solved before substantive progress can be made on any of the other major issues facing the nation and the world today.

His argument is summarized in the accompanying diagram: To obtain the money needed for their next election campaign, incumbent politicians spend a substantial portion of their time extorting (Lessig's term) money from big business.[1][2] Businesses pay because they get between $6 and $220 (according to different studies) for each $1 "invested" in lobbying and political campaigns.[3]

Media scholar Robert W. McChesney claims the media play a major role in perpetuating this corrupt system. "A five-year study of investigative journalism on TV news completed in 2002 determined that investigative journalism has all but disappeared from the nation's commercial airwaves."[4] The reasons are easy to see from the economics of broadcasting:

- The recipients of governmental favors can retaliate either by moving advertising budgets or through legal action. (I.e., advertisers don't like feeding the mouths that bite them.)

- Advertising rates are set by the size and purchasing patterns of the audience. A commercial media outlet can make money attacking advertisers only if by doing so its audience grows enough to offset the revenue lost from advertisers who spend their money elsewhere. This effect is exacerbated by the fact that the media tend to develop themes so they can get multiple reports from a given level of journalistic effort. Extreme examples of this have been called media feeding frenzies.[5] (Media feeding frenzies that target major advertisers are rare, because the media don't like biting the hands that feed them.)

Defining crony capitalism

[edit | edit source]Investopedia defines "crony capitalism" as "A description of capitalist society as being based on the close relationships between businessmen and the state. Instead of success being determined by a free market and the rule of law, the success of a business is dependent on the favoritism that is shown to it by the ruling government in the form of tax breaks, government grants and other incentives."[6]

This initiative to "document crony capitalism" is devoted to situations where major business interests invest amounts of money in campaign contributions beyond the capabilities of people with typical incomes and receive favors from government that appear to provide substantial return on the "contributions". The question is not whether there is a quid pro quo but rather whether a reasonable person might wonder if these contributions might have excessive influence on government decisions benefiting contributors at the expense of the public.

Crony capitalism costs the median American family $100 per day

[edit | edit source]

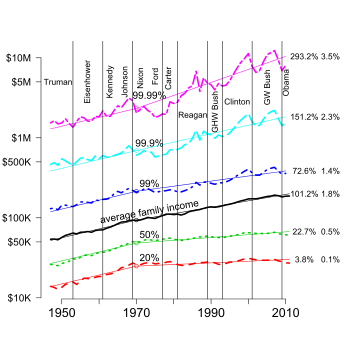

The accompanying figure displays the evolution from 1947 to 2010 of the income distribution in the US. The solid black line in the middle is the average family income [Gross domestic product (GDP) per household adjusted for inflation]: It increased at roughly 2.2 percent per year from 1947 to 1970 and at roughly 1.8 percent since. The increase at 1.8 percent per year accumulates to 101.2 percent over the 40 years between 1970 and 2010. In other words, the US economy today produces double the goods and service per person as it did 40 years ago.

The gap amounts to $39,000 per year or roughly $100 per day. This is real money that the median American family would receive if the US had had the same economic growth it had since 1970 and the income distribution had remained the same as it was between 1947 and 1970. Instead, that money is going to those better off.

For this to be anything other than a fictional computation, we'd like to understand what factors determine the rate of economic growth and how the benefits are distributed.

Market failures

[edit | edit source]

An economic transaction can occur any time the benefits to consumer exceed the cost to the producer. However, exactly how the benefits of that economic transaction are shared between consumer and producer is essentially a political decision.

For example, suppose it costs me a penny to produce something that's worth a dollar to you. What's the price?

The price is fundamentally political: If I'm the only producer with lots of potential customers, I can set the price at 90 cents or higher. If there are many producers and only one buyer, the price will be closer to 1.1 cents.

So-called free markets serve the public only to the extent that (a) all the costs to society are appropriately reflected in the price to the consumer, and (b) asymmetries of power and information are negligible. Virtually all real markets are distorted by market failures violating one or both of these conditions.

For example, the negative impact of air and water pollution on human health is a cost to society that is only reflected in the price to the consumer if there is appropriate governmental intervention.

Businesses that poison their neighbors with impunity often obtain a higher profit than competitors who spend money to reduce toxic materials dumped into the water or air: The increased health costs from inadequately controlled emissions are real costs that society bears that are typically not reflected in the price to the consumer. Consumers are pushed by the market mechanism to buy the cheaper goods, thereby potentially increasing the total costs to society from the increased health problems of people living downstream from a polluting facility.

If either producer or consumer is a monopoly or an oligopoly, that party effectively sets the price to capture most of the benefits of the transaction. Many monopolies are regulated and achieve high profits because of regulatory capture, whereby their political campaign contributions and lobbying effectively allows them to place their people in charge of government regulatory agencies. This in turn ensures that the regulated monopolies obtain better return on their investments than they would in a competitive market. Oligopolies often exist as a result of a variety of government actions that protect the biggest players from the consequences of their own mistakes (e.g., banks that are deemed too big to fail).

Some of the benefits of size (economies of scale) are legitimate while others are illegitimate in that they result from government actions that protect cronies at the expense of others. Legitimate economies of scale include more efficient production processes and sharing brand name recognition. However, many major corporations are larger than they would be without favors granted by government, e.g., allowing mergers and acquisitions that harm consumers by giving a producer undue power in negotiating a price with consumers. These are illegitimate economies of scale.

These issues are mentioned here, because governmental favors to cronies come in many forms: Direct subsidies. Tax breaks. Exceptions to reasonable environmental and workplace safety standards. Foreign policy and national defense initiatives that limit the abilities of people in foreign countries peaceably to assemble and petition for better wages, working conditions and environmental protection. These all support major corporations using tax money paid by less affluent citizens and smaller or less politically savvy competitors.

United States antitrust law is designed to restrict actions including mergers and acquisitions that could substantially lessen competition. However, many of the people who control the largest advertising and political campaign budgets want to merge or acquire competitors precisely to reduce competition and allow them to obtain higher profits. The major media conglomerates have a conflict of interest in reporting accurately on these events for two reasons:

- Many business executives lobbying for governmental approval of a merger or acquisition also control substantial advertising budgets. Media organizations have in the past lost profitability when major advertisers decided to spend their advertising money elsewhere.

- The media conglomerates are themselves major oligopolists and would not want the public to question their own mergers and acquisitions and the resulting higher profits.

Milton Friedman and others have argued that the costs of government failure exceed those of the market failures they are trying to overcome. However, the cost of government failures may be a function of the level of engagement of the population in civil society aimed at monitoring and manage government activities.

One index of the level of tax giveaways is the number of words in the tax law. The Tax Foundation counted the number of words in the code (written by congress) and regulations (written by administrators) for the US federal income and other taxes. In the half century between 1955 and 2005, the total words in code and regulations increased from 1.4 to 10 million; see the accompanying figure. Advocates for the current system have argued that the complexity of the US economy requires a complex tax system. The Tax Foundation report on this says that the complexity of the tax law carries a substantial "cost of compliance", as the work required to prepare tax reports do not provide useful goods or services to anyone.[10]

Other favors to cronies appear elsewhere in non-tax subsidies, environmental and workplace safety laws and administration, and a variety of trade barriers including so-called free trade trade agreements. For example, the North American Free Trade Agreement allows subsidies to US agribusiness but not to Mexican peasant farmers. One result was the Zapatista uprising in Chiapis.

Factors impacting economic growth and income distribution

[edit | edit source]Theories of economic development (including economic growth and development economics) focus especially on the rate of investment in human and physical capital, though many other factors are considered. Vernon (1989) claimed that a key to economic growth is limiting the power of veto groups to block innovation. This power is typically obtained by cronies of high ranking government officials. For much of human history, innovations acceptable to those in power have generally been restricted to military technology and luxury goods. "In the 17th century, ... governments did not yet feel that technologies that might raise the living standards of ordinary people ... were their responsibility."[11] Worse, anything that might raise the aspirations of commoners could threaten the aristocracy and were therefore routinely suppressed. The economic growth visible in the plot of income distribution vs. time is, according to Vernon, a product of limits set by governments on the power of potential veto groups.

David Graeber's book Debt: The First 5000 Years provides a broader perspective: For as far back as we can see in the historical and archaeological record, people with wealth and power have written the rules to benefit them at the expense of others. Repeatedly throughout the last 5000 years, the situation has deteriorated for commoners until it was interrupted by a peasant revolt. New kings, chiefs, or emperors arose, and the cycle began again.

Franklin Roosevelt's New Deal could be described as a peasant revolt instigated by the disastrous economic policies of Herbert Hoover in creating and exacerbating the Wall Street Crash of 1929. The broad sharing of the benefits of economic growth evident in the accompanying figure from 1947 to 1970 could be described as a product of governmental changes brought in by the New Deal including the relative strength of organized labor. According to this theory, by 1970 the Roosevelt coalition had lost sufficient power that the process described by Graeber began to reassert itself. This generated the increases in income inequality evident in the income distribution plot above.

The political consensus that produced the relatively narrow income distribution from 1947 to 1970 included high tax rates on top incomes. Arguments against such taxes include the following:

- High tax rates encourage tax evasion. This argument was made by US Secretary of the Treasury Andrew Mellon in 1924. Most of the complexity of the U.S. income tax code is a testament to the effectiveness of crony capitalists in obtaining legal ways to avoid taxes, consistent with Mellon's observation.

- People with high incomes create jobs, and high taxes discourage them from doing so. Rollert in salon.com described this as 'The hardy myth of “job creators”'.[12] This argument implies that the rate of economic growth since 1970 would have been lower than it was without the increases in income inequality apparent in the accompanying figure. This claim deserves more careful scrutiny. History is replete with examples of governments stifling (or enabling veto groups to stifle) economic growth. However, the opposite could be more real, namely that economic growth could come in part from the radical notion that common people should share in the fruits of their labor. Policies to increase broadly shared economic growth might be built on increasing public debate of crony capitalism in a way that identifies and reduces the power of potential veto groups -- and reduces the concerns of people who might lose their jobs as a result of innovations.

"Documenting crony capitalism" is an initiative to crowdsource research and investigative journalism to document crony capitalism. It is motivated by a desire to provide a central place for documentation of details on the mechanisms behind the divergence observed in the income distribution since 1970. By stimulating more informed public discussion of the issues, the U.S. might experience more economic growth with the benefits more broadly shared, as they were in 1947-1970.

Making politics the national sport: Don't get angry — get curious

[edit | edit source]Two key obstacles to fixing the current system are discussed here: (1) The limited ability of people of different political persuasion to communicate. (2) Lack of easy access to documentation of the details, so governmental giveaways can be effectively challenged.

- Lessig[13] talked with both the Tea Party and the Occupy movement. He found they had two things in common: (a) Both were concerned about crony capitalism. (b) Both contained elements that labeled as treasonous any attempts to talk with the other. To make progress, we must recognize that a major obstacle to success are things we don't know. Our nominal opponents may know things we don't. Or they may be influenced by inaccurate claims. In either case, our inability to find common ground with them is evidence of something we don't know. To be successful we must get curious: Ask questions -- in a friendly supportive way. Listen to the answers. Then challenge our own assumptions about reality and about the other side. Then iterate, asking more questions and listening more. Practice dialogue.

- One obstacle to fixing this system is simply documenting the details in a place where people of all political persuasions can exchange views on whether any given governmental decision (subsidy, trade barrier, allowing a merger, etc.) qualifies as an inappropriate subsidy provided at the expense of the public as a result the current system of campaign finance — crony capitalism.

The need to talk politics in a democracy was enunciated in 1927 by US Supreme Court Justice Louis Brandeis: "Those who won our independence believed ... that the greatest menace to freedom is an inert people; that public discussion is a political duty; and that this should be a fundamental principle of the American government."[14]

But where can we find the time to do all this? Two sources come to mind:

- How about making politics the national sport? Spend more time on politics and less on other leisure activities such as sports.

- As noted above, the bottom 99% in the US work more than they did 40 years ago, and they get less for it. By contrast, our counterparts in Europe have not suffered an explosion in income inequality similar to that documented above. If we become less eager to work overtime or work a second job, we will have more time for family and friend and for shopping more carefully — especially for big ticket items like housing and transportation (e.g., automobiles) — and for talking politics.

If we do this, we can begin to transfer less of our money to the wealthy, have more control over our lives, and enjoy life more.

This "Documenting crony capitalism" initiative hopes to provide a central repository for the evidence for and against alternative points of view — a place where the Tea Party and Occupiers and all others can cite and question evidence and interpretations. We hope to do this in a way that will allow results to be compiled and summarized in different ways depending on your point of view. We hope this will help people set aside their differences, become intellectually honest, and find common ground — so they can agree to disagree agreeably and work together effectively on issues of common concern. In this way, we hope that this compilation will help inspire citizen action that is sufficiently effective in blocking the most egregious governmental giveaways that the "gateway problem" described by Lessig can be overcome, and the nation can more effectively confront many of the other major problems facing humanity.

Suggestions on how to create a Category:Documenting crony capitalism article are described with Template:Documenting crony capitalism.

References

[edit | edit source]- Lessig, Lawrence (2011). Republic, Lost: How Money Corrupts Congress -- and a Plan to Stop It. Twelve. ISBN 978-0-446-57643-7.

- Lessig, Lawrence (2012). One Way Forward: The Outsider's Guide to Fixing the Republic. ISBN 978-1-61452-023-8.

- McChesney, Robert W. (2004). The Problem of the Media: U.S. Communication Politics in the 21st Century. Monthly Review Press. ISBN 1-58367-105-6.

- McChesney, Robert W.; Nichols, John (2011). The Death and Life of American Journalism: The Media Revolution that Will Begin the World Again, paperback edition with two new original chapters. Nation Books. ISBN 1568586361.

- Vernon, Raymond (1989), "Technological Development", EDI Seminar Paper, 39

Notes

[edit | edit source]- ↑ Tom Ashbrook (January 2, 2012), "Lawrence Lessig on Money, Corruption and Politics", 90.9 wbur (Boston's NPR), retrieved 2012-01-23

- ↑ Herrnson and Facheaux (2000) surveyed almost 2,000 candidates for office in the late 1990s. They found that the time devoted to fundraising tended to increase with the amount of funds raised and the level of the office with 23.3 percent of candidates for statewide office spending over half their time fundraising and 55 percent spending over a quarter of their time. Local and judicial candidates need less money, and less than 6 percent of them spend over half their time asking for campaign contributions. Herrnson, Paul S. (July 7, 2000), Candidates devote substantial time and effort to fundraising, retrieved February 10, 2013

- ↑ Lessig (2011, p. 117)

- ↑ McChesney (2004, p. 81)

- ↑ Sacco, Vincent F. (1995). "Media constructions of crime". Annals of the American Academy of Political & Social Science 539 (1): 141-154. cited from Sacco, Vincent F. (1998), "Media constructions of crime", in Potter, Gary W.; Kappeler, Victor E. (eds.), Constructing Crime: Perspectives on Making News and Social Problems, Waveland Press, pp. 37–51, ISBN 0-88133-984-9; see especially the section on "The Content of Crime Problems", p. 42 in Potter and Kappeler

- ↑ Crony Capitalism, retrieved March 24, 2013. For an alternative definition, see crony capitalism, Business Dictionary, retrieved March 24, 2013

- ↑ "Table F-1. Income Limits for Each Fifth and Top 5 Percent of Families (All Races): 1947 to 2010", Current Population Survey, Annual Social and Economic Supplements, United States Census Bureau, retrieved 2012-01-24 Note: Median computed as the geometric mean of the 20th and 40th percentiles

- ↑ Piketty, Thomas; Saez, Emmanuel, Atkinson, A. B.; Piketty, Thomas (eds.), Income Inequality in the United States, 1913-2002, retrieved 2012-02-08

{{citation}}: Unknown parameter|booktitle=ignored (help) - ↑ The differences between the Census and Internal Revenue Service Data can be seen most easily in the 95th percentile, present in both data sets. For more details see the help file for the "incomeInequality" data in the Ecdat package available from the Comprehensive R Archive Network (CRAN; see r-project.org).

- ↑ Moody, J. Scott; Warcholik, Wendy P. Warcholik; Hodge, Scott A. (December 2005), The Rising Cost of Complying with the Federal Income Tax, Special Report No. 138, The Tax Foundation, retrieved February 21, 2013

- ↑ Vernon (1989, p. 5)

- ↑ Rollert, John Paul (September 28, 2011). "The hardy myth of “job creators”". Salon (salon.com).

- ↑ Lessig (2012)

- ↑ Whitney v. California, 274 U.S. 357, 375 (U.S. 1927) (“Those who won our independence believed ... that the greatest menace to freedom is an inert people; that public discussion is a political duty; and that this should be a fundamental principle of the American government.”). Overruled in part by Brandenburg v. Ohio, 395 U.S. 444 (U.S. 1969). Cited from Overton, Spencer (2012), The Participation Interest, George Washington University Law School Public Law and Legal Theory Paper No. 2012-119, retrieved March 29, 2013